© 2021 by Tax Lien University, Inc. All rights reserved. Tax Lien University, Inc. and its subsidiary Creating Wealth Without Risk™, Inc. (The Company) does not guarantee income or success, and examples shown at TaxLienUniversity.com and CreatingWealthWithoutRisk.com do not represent an indication of future success or earnings. The Company declares all information shared is true and accurate, and any claims made of actual earnings or examples of actual results can be verified upon request.

We are required by the FTC to disclose the typical customer results. Quite honestly, the typical customer does not make any money whatsoever. In fact, the typical customer does not even finish the training videos. Less than 1 in 100 ever ask a question of our coaches, leave feedback or otherwise show they're putting in any focused effort at all. Like anything worthwhile, our educational products require work. The typical customer puts in very little work. Before you buy, you should stop and ask yourself if you're typical.

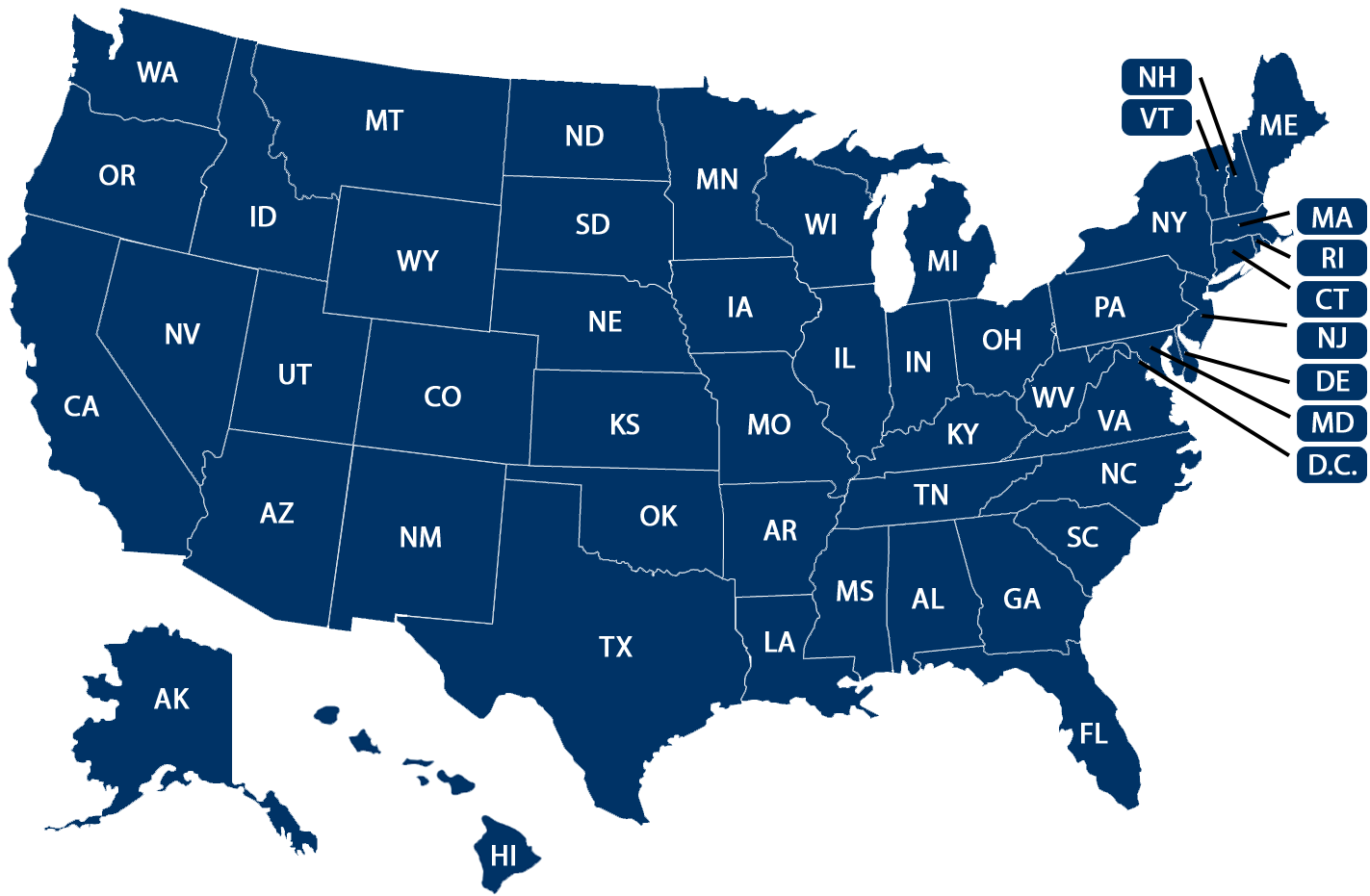

Offer valid in the US and Canada. Limit one (1) copy per household, must be 18 years of age or older. Upon submitting the form above you will be given the choice between a physical 4-Disc version or a digital download version. If you select the physical version the normal retail charge of $39.97 is waved however you will be charged a one-time USPS shipping and handling charge of $9.95. If you select the digital download version there will be no charge and you can immediately download the contents of your selection.

The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few.

Because of impediments due to any one or more of the foregoing and other factors, it is generally expected that no earnings, revenues or profits will be achieved with the use of any products or services advertised on this site in circumstances similar to those referenced in any endorsement or testimonial.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Your use of this website constitutes acceptance of the disclosures, disclaimers, privacy policy, no spam policy, and terms of use.